Guide to Amazon Sales Tax: See Which States Amazon Collects Sales Tax For & What You Need To Do As A Retail Arbitrage Seller (Updated Sept 2021)

One of the most common questions I am asked about selling on Amazon doing retail arbitrage is what about sales tax. Do I need to collect it? How do I collect it? How do I get a sales tax permit, or resale certificate, or sales tax license? Do I even need one?

The good news is that Amazon now collects sales tax for you in 45 states + DC (as of Sept 2021). When I started selling in 2017, this was not the case and it made starting out that much more confusing. Luckily, the Marketplace Facilitator Law changes in most states have now forced Amazon to collect sales tax for us, making our lives, a little easier.

First let me tell you, I am not a tax expert and all of the following information is my own personal experience and pulled from Amazon themselves. You should consult with your accountant or tax expert to see what is right for you and your business. I only sell on Amazon so I am only talking Amazon. If you sell on other platforms, you will need to check with them to see if they collect it for you or if you are responsible.

If you sell on Amazon, congrats! You are an ecommerce seller!

As a seller, you are required to collect sales tax in states where your business has nexus. Nexus means your business has a presence in some way tied to that state.

The most obvious example is your home state, where you live and do business from. Even if you are a sole proprietor and not registered as a business with the state, you have sales tax nexus in that state.

You also have nexus in any states your customers send their orders to. If you are a seller based in Tennessee and a customer orders and has their product shipped to California, you now could have sales tax nexus in California as well as Tennessee. With Amazon shipping and selling all over the US, your sales tax nexus liability quickly adds up to a lot of states.

The less obvious examples of sales tax nexus for Amazon FBA sellers are when it comes to your inventory. Any state Amazon ships your FBA inventory to, you now could have nexus in. Not just the warehouses and states you send your shipments to, but all those times Amazon is transferring your stock around to different warehouses. You might recognize this as being called FC Transfer (Fulfillment Center Transfer) in your “Manage Inventory” screen.

Amazon has warehouses in 35 states. You can see a list of where they all are here. This, along with your customers ordering all over the country is where the sales tax nexus headache begins.

Now remember the good news I mentioned earlier?

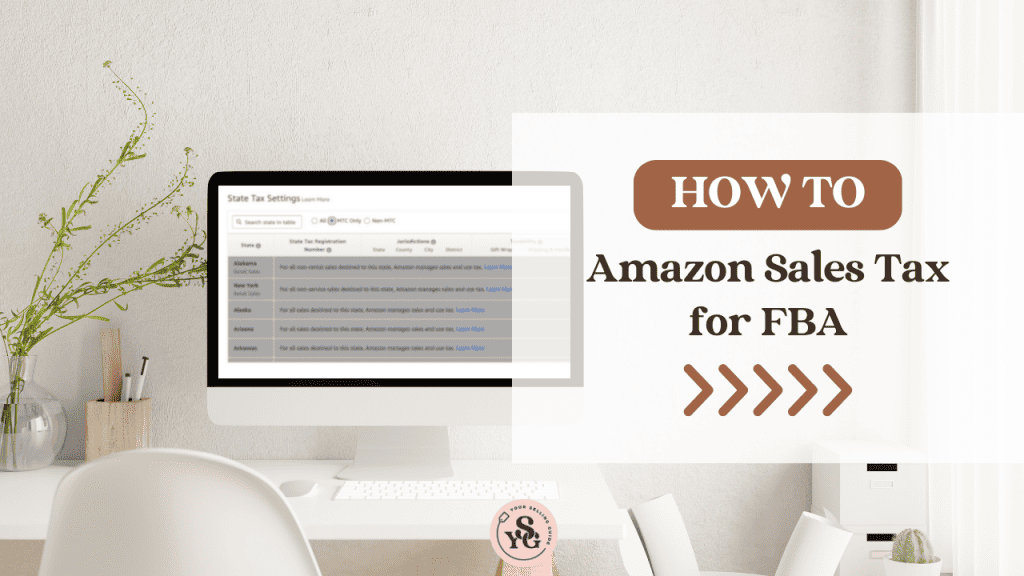

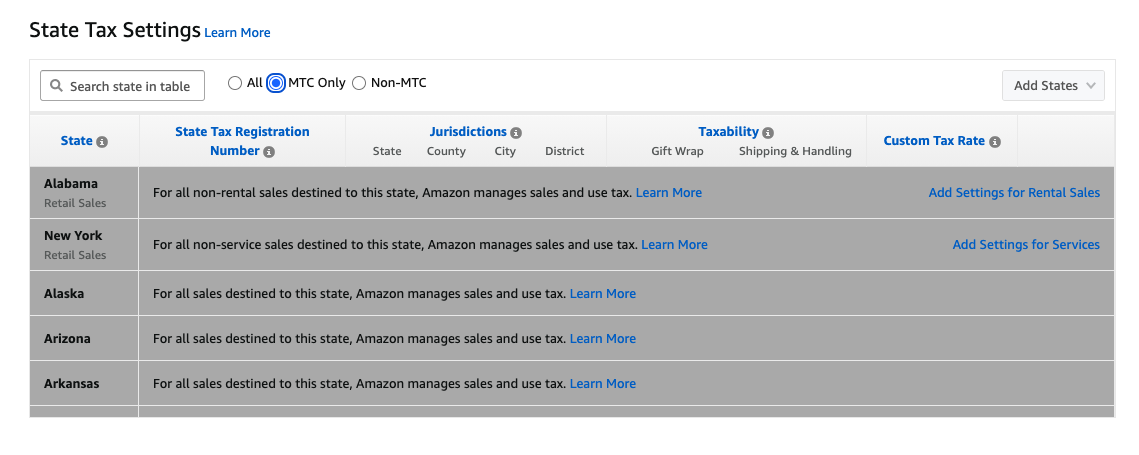

This is where you can most likely give a sigh of relief. Amazon collects and remits sales tax for you as the marketplace facilitator in 45 states + DC. You can see the states in your account on Seller Central: navigate to “Settings” and select “Tax Settings” from the menu. On this screen you will see all the states Amazon is collecting in grey. You can scroll through to see if your state is here.

There are 4 states which do not have sales tax at all: Delaware, Montana, New Hampshire, and Oregon (Fun fact: I’m from Oregon!)

This leaves just 1 state which Amazon DOES NOT collect and remit sales taxes for and which you may be responsible for collecting and remitting sales tax to: Missouri. Amazon does have a fulfillment center in that state so you likely do have nexus there.

I have used Tax Jar for all my sales tax needs since they are the most thorough on explaining it and their service connects to your Amazon account and tells you exactly what you owe in each state. In order to file and pay your sales taxes to Missouri, you would first need to apply for a sales tax permit.

State Amazon Does Not Collect Sales Tax On Your Behalf

Now if you are lucky to live and work out of a state where Amazon collects sales tax for you, you may still want to register for a sales tax permit. This way you will not have to pay sales taxes on your retail arbitrage purchases at some of the national retailers and you will need it if you want to get ungated to sell in Toys. Stay tuned for more on shopping tax exempt!