Taxes and insurance are some of the least fun parts of any business, but sellers need to make sure they handle Amazon FBA sales tax and Amazon FBA insurance correctly. I will explain when Amazon collects sales tax for FBA sellers and when you need insurance for Amazon FBA. In this blog post, we will only discuss Amazon seller sales tax, not income tax, and only Amazon FBA taxes for the United States.

Disclaimer: I am not a CPA, tax expert, or insurance expert. I am simply sharing what I know from my experience with my own Amazon FBA business and Amazon’s information with sellers. You need to do your own research to make decisions for your own business.

Does Amazon Collect Sales Tax for FBA Sellers?

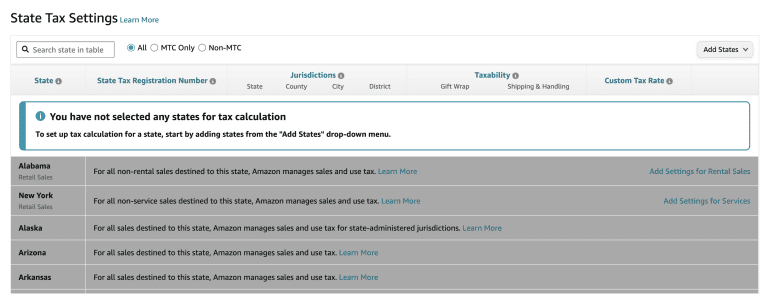

The great news is that Amazon almost always collects and remits sales tax for FBA sellers in the United States. Amazon is required to remit taxes in almost every state that collects sales tax, thanks to the marketplace facilitator laws.

According to TaxJar, “A marketplace facilitator is a business or organization that contracts with third parties to sell goods and services on its platform and facilitates retail sales.” In other words, Amazon is a marketplace facilitator, and we as Amazon FBA Sellers, are the third parties.

As TaxJar explains these laws, “Several states have created legislation that requires marketplace facilitators to collect and remit sales tax on behalf of their third-party sellers’ transactions.” Many states have laws requiring Amazon to collect and remit the sales tax on behalf of its FBA sellers.

Collecting and remitting sales tax for every state is complicated, and Amazon has the infrastructure to manage it for us. Amazon has to collect and remit the sales tax for Amazon FBA sellers in every state with sales tax and a marketplace facilitator law. That’s good news for Amazon sellers and makes managing Amazon FBA sales tax much easier.

There used to be some states that did not have marketplace facilitator laws, but now those laws are enacted in all 50 states. Florida, Kansas, and Missouri were the last states to enact those laws. Missouri’s law goes into effect on January 1, 2023. So as of today, Amazon is not facilitating sales tax in that state, but beginning in 2023 they will be for all 50 US states.

Amazon FBA Sales Tax: Nexus

What is nexus? Nexus is your status of physical ties to a state, such as a state where you’re domiciled, live, or have a business registered. Technically, it is a nexus event any time you ship an Amazon order to a state. If you’re an FBA seller and have a product sent to or through a warehouse, it is a nexus event in that state.

It used to be that Amazon Sellers would have to remit Amazon sales tax in any state where they had nexus, and there were no marketplace facilitator laws. Thankfully, since all 50 states will now uphold marketplace facilitator laws, this is no longer a concern.

If you have any questions about which status you have nexus in, programs like Tax Jar and Quaderno can help.

Remitting Amazon FBA Sales Tax

Before marketplace facilitator laws, you would have to get a resale certificate and remit sales tax to any state you owe, either quarterly or annually. However, now Amazon will collect and remit all your Amazon FBA sales taxes for you in all states.

If you DO have a resale certificate or sales tax exempt certificate in your state to purchase products sales tax-free for resale, you DO still need to file your sales taxes, even if it’s $0 or you may find yourself looking at fines for late filings. Again, even if Amazon is remitting your sales tax for you, you still need to file if you hold a sales tax certificate in any state – even when it means filing $0.

Amazon FBA Business Insurance Requirements

Whether you need Amazon FBA business insurance is dependent on your revenue as an Amazon seller. Amazon details their Amazon FBA insurance requirements in item 9 of the “Amazon Service Business Solutions Agreement” you signed when you became a seller.

Item 9 states the Amazon FBA business insurance requirements. In short, if your Amazon FBA business exceeds $10,000 gross proceeds in a three-month period, then you have thirty days to obtain your general liability insurance umbrella policy and send the certificate of insurance to Amazon.

Keep in mind that this is $10,000 for your total sales number, not $10,000 in profit. You then have to keep the insurance from now on as an Amazon seller, even if you no longer sell $10,000 per quarter. Amazon may also ask you for proof of insurance at anytime and at that point, regardless of your total sales volume, you have 30 days to provide them with proof of insurance.

If you never sell as much as $10,000 in three consecutive months, then Amazon exempts you from the insurance requirement. However, you may still want to consider obtaining insurance.

The Amazon FBA insurance requirements only apply to professional sellers. Individual sellers are not required to get insurance.

Purchasing Amazon Insurance for FBA Sellers

You can purchase insurance for Amazon FBA sellers from any insurance company or agent. Contact your existing insurance agent, or google “FBA selling insurance” to browse options and shop around for the best price.

An LLC or business license is not required to purchase the insurance needed for Amazon sellers; you can get it as a sole proprietor.

The insurance for Amazon FBA can be commercial general, umbrella, or excess liability insurance. The policy must cover at least $1 million per occurrence or in aggregate. The policy must be in the same name as your account and name Amazon on the policy. Amazon will provide the language for the policy that you can provide your insurance company.

I originally purchased my Amazon FBA liability insurance coverage for $250 per year, but the prices fluctuate a lot, and it’s now closer to $400 per year. However, it is a business expense and tax write-off.

Amazon FBA Liability Insurance Requirements

-

Not required unless your total sales number exceeds $10,000 in three consecutive months

-

Commercial general, umbrella, or excess liability insurance policy

-

Policy must cover at least $1 million per occurence or in aggregate

-

Be in the same name as your account and name Amazon on the policy

-

Use the language Amazon provides for the policy

Amazon FBA Sales Taxes and Liability Insurance

I hope this pointed you in the right direction to manage your sales taxes and liability insurance for your Amazon FBA business. It’s important to get these important elements in order to mitigate risk, serve your customers, and focus on building a profitable Amazon FBA business.

There are a lot of details like taxes and insurance in Amazon FBA. To ensure you get started on the right foot instead of learning by trial and error, check out my Beginner Amazon FBA course.

Video: Selling Insurance & Amazon FBA Sales Tax

Check out my YouTube channel for the video version of this post and other Amazon FBA videos.