It’s time for the annual, no-fun topic, INCOME TAX!

Taxes are the least fun topic as a business owner, but if you have sold over $600 on Amazon, then it has to be reported. In today’s post, I’m covering all the different things I have learned, and answering your frequently as questions regarding Income Tax and Your Amazon Selling Business.

Note: I am NOT a tax expert, I am just giving you information I know of and you should consult with a tax professional or CPA. All information below is for sellers who have a professional account. If you have an individual account some information may be different on the Amazon side.

Accountants & Bookkeepers

I was an avid TurboTax user for most of my tax paying life. The good news is, however you did your taxes BEFORE selling on Amazon, you can still do it that way! I changed to a CPA as my businesses grew for the peace of mind a tax expert brings. I have now hired a professional the past four years, and it’s worth it not only for the professional advice, but also because I don’t have to figure it all out on my own every tax season. Income Taxes and Your Amazon Selling Business can be stressful if you don’t know what you are doing. Seek assistance if you are unsure.

Hiring an Accountant

Whoever you decide to hire to handle your Income Tax for your Amazon Selling Business, they do not need to be “Amazon Specific”. You are running an inventory-based business, if the accountant you are considering knows and is experienced with how to file inventory-based businesses, that is all you need.

Hiring an accountant can cost anywhere from $400-$1000 a return. For my business returns, I have paid $1000 previously, but my new accountant only charges $700 a return. For my personal returns, I have paid anywhere from $200-$600 for federal and state.

How you set up your business (LLC, Sole Proprietorship, S Corp, etc.) will determine how and when you file your taxes. Single member LLCs do not have to file a tax return with the IRS. It all flows through to your personal filing. S corps and partnerships DO have to file business tax returns and they are due on March 15th. From my personal experience, you don’t pay taxes with those filings, the income or loss your business made passes through to your personal returns.

Hiring a Bookkeeper

When hiring a bookkeeper, I would look at experience. Rates for bookkeepers vary tremendously. Most of the time, they will need to look into your QuickBooks and will ask questions about your business before giving a solidified rate. Look around, or ask others in your community for recommendations. A good bookkeeper will have ongoing questions in the beginning and should be sending you monthly reports. If you don’t like the one you currently use, look for a new one. This should be a partnership between the both of you. I have paid anywhere from $100-$600 a month for bookkeeping on my businesses. It usually comes down to how many accounts you have linked and how many transactions you have a month.

Frequently Asked Questions: Income Tax and Your Amazon Selling Business

Now let’s answer some common questions! I spoke to my tax professional and here is what he said…

Note: Please remember this is not tax advice and you should talk to a professional about your own personal situations.

Home Office

If you have a home office, you can deduct that on your taxes. You take the total square footage of your house (If the garage is used for your business, add that in too), then you take your office space and see what percentage of the whole is your office.

Office Square Footage/Total Square Footage

For example we will say your home office is 25% of your whole house. You can now deduct 25% of ALL your shared household bills & utilities including mortgage, electric, trash, water, Internet etc. (The only exception is property tax and mortgage interest because that is already 100% tax deduction).

You must be able to prove that your office space you are deducting is used solely for your business, always talk to your accountant and see what is right for YOUR taxes.

Meals

If you are away from your home for more than 24 hours, all the expenses you incur, including meals and hotels are tax deductible. Every business is unique, even among Amazon sellers so this would be another great question to ask your own tax professional.

1099 Contractor Help

Any expenses incurred for contractor is tax deductible. You can write off wages paid, meals purchased for them, supplies purchased for them, health insurance, etc. You can get blank 1099 forms from an office store and make your own. I personally pay through Paypal and Gusto, and they complete the 1099s for me. Paypal is free, Gusto is not.

When it comes to hiring spouses and/or kids, I did not speak to my personal accountant but I did interview Mark Tew, from Not Your Dad’s CPA, for the Your Selling Podcast on this topic. If you are married, filing jointly you do not need to issue a 1099, you would pay them as an owner’s draw. For your children, you do need to issue a 1099, but there are legal limits like the standard deduction that if you pay them less than that, they would not pay taxes. Again, your accountant can help you more with the specifics on this.

Mileage

There is no cap on mileage deduction. Anytime you are driving for business purposes you can claim those miles. A common example asked, was if you drive from home to Target, then Target to pick up a kid from school, is that mileage deductible? Only the home to Target is business mileage. From Target to school is now personal, and you cannot include that.

Pulling Reports for Tax Time

Now that we’ve gone through some frequently asked deductions, let’s look into the reports you will need! Below, are all the reports you will need to prepare either for yourself, or for your accountant.

Inventory Valuation Report

The First Report you should pull if you haven’t already is your Inventory Valuation report.

This report is essentially telling you how much inventory you ended the year with. You can pull the report at any time to see how much inventory you have in the warehouse. This report is a factor in your overall Cost of Goods Sold (COGS) for the year which is an expense on your taxes.

If you started selling on Amazon this year, your starting inventory will be 0. If you sold last year, you should have this same report from the year prior. When you pull it for December 31st, you are getting both your ending inventory as well as your starting inventory for the next tax year.

To pull your report:

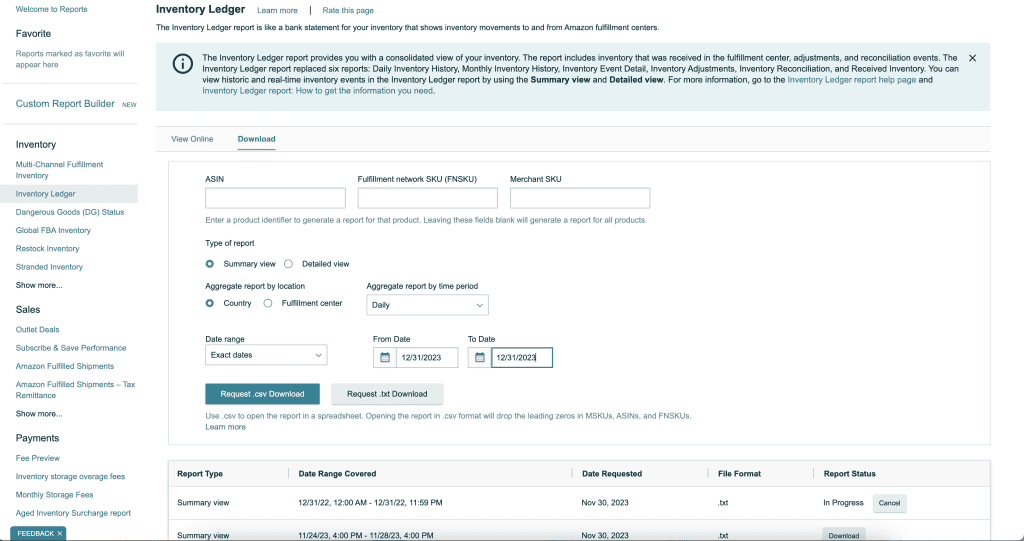

- From your Seller Central account head to “Reports” and select “Fulfillment”

- In the top Inventory section, select “Inventory Ledger”

- Click the “Download” View to be able to generate a downloadable file

- Select the “Summary View”, “By Country”

- Time period select daily because you only need what was there on 12/31.In Date range click exact dates and then pick 12/31

- Request the download in either .csv or .txt whichever one you prefer. It will then appear in the list of reports here on the page when it’s completed.

If you use Inventory Lab you can get the report by heading to Reports – Inventory Valuation, and then clicking the date you want (Shoutout to YSG Community member Alicia Jackson for sharing this!).

In Sellerboard to get the report go to, Reports – Stock History Report (Shoutout to YSG Community member Liz Jackson for sharing this!)

Amazon 1099-K

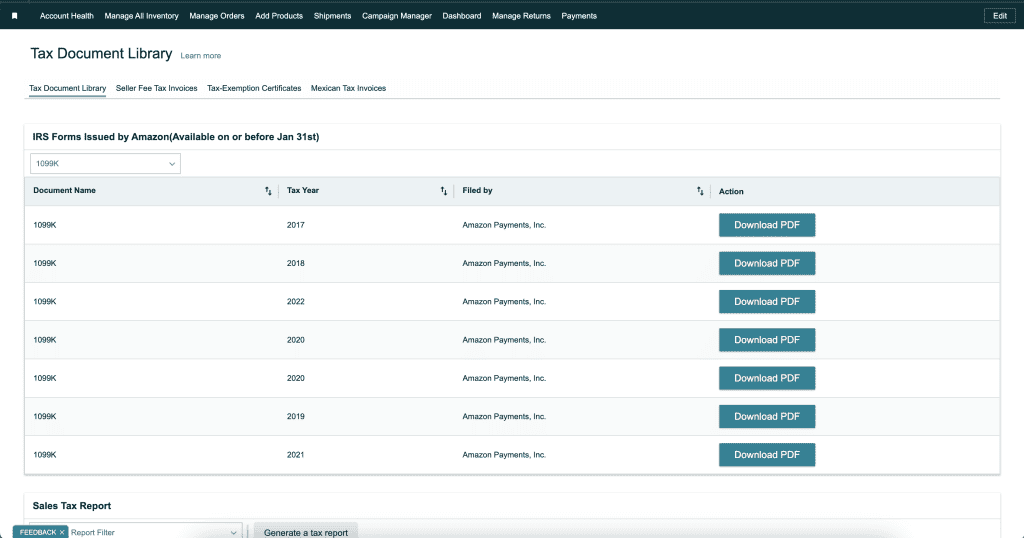

The next report you will definitely need to grab is the 1099-K! If you did over $5,000 in sales (gross sales not profit) you will receive a 1099-K from Amazon. A 1099-K is the Payment Card and Third Party Network Transactions form, it is used to report transactions that are made via a payment processor. Amazon is the payment processor taking customer cards and so they report the amount they sent you to the IRS and provide you with the 1099-K.

If you met that threshold, the document will automatically appear in your Tax Document Library in Seller Central in the month of January, usually around the 3rd or 4th week. This document can be found under “Reports” > “Tax Document Library”. There is nothing you need to do or request from Amazon.

Amazon Payments Report Repository

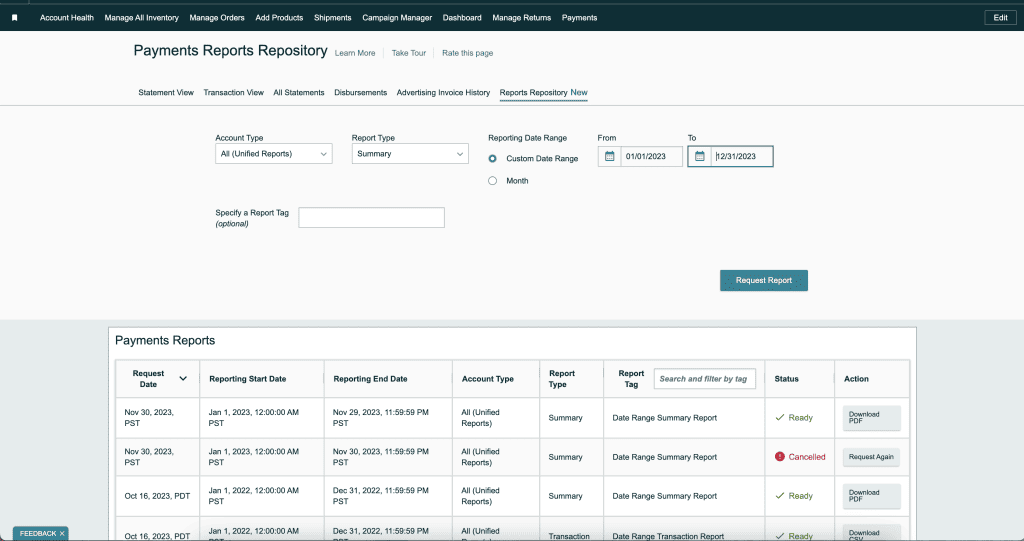

There is another report that goes along with the 1099 that I would absolutely advise you run! Make sure to pull the Payments Report Repository so you can get a full picture of all your amazon payments and expenses – and that way you can report them and write off what needs to be. This includes things like – shipping, taxes, storage fees, etc. that you will need for your taxes as well.

To pull your report:

- Log in to Seller Central go to PAYMENTS > REPORTS REPOSITORY.

- It probably already is but make sure the account type you want says ALL (UNIFIED REPORTS).

- Select the SUMMARY option under Report Type.

- Select the CUSTOM date range option and enter from 01/01 of the year to 12/31 of the same year.

- Click REQUEST REPORT.

More on Income Tax

Thank you so much for reading along – talking about taxes with your Amazon Selling Business is always a long one! If you’d like the video version, you can watch it by clicking below or heading over to my Youtube channel. I share screenshots and step by steps through out the video. You can also check out the Your Selling Podcast – Episode 46 is an Interview with Mark Tew from Not Your Dad’s CPA, where we dive more into bookkeeping!