It’s that time of year again for Amazon Selling and the not-so-fun topic of INCOME TAX!

Taxes might not be the most exciting part of being a business owner, but if you’ve sold over $600 on Amazon, it’s something that needs to be reported. In today’s post, I’m sharing everything I’ve learned about navigating income tax season as an Amazon seller and managing 2025 taxes for your business. Let’s make this process a little less daunting!

Note: I am NOT a tax expert, I am just giving you information I know of and you should consult with a tax professional or CPA. All information below is for sellers who have a professional account. If you have an individual account some information may be different on the Amazon side.

Amazon Selling Reports You'll Need for Your 2025 Taxes

Below, are all the reports you will need to prepare either for yourself, or for your accountant.

Inventory Valuation Report

Before we jump into this report, let’s talk about why you might – or might not – need it.

While there are two methods of doing a businesses accounting overall, there are also two methods of accounting for inventory specifically. Personally, I do not need this report because my accountant and I do my overall business on the accrual basis, however my inventory is on the cash basis.

For Inventory, the “accrual basis” means recording the cost of goods sold (COGS) with the S being very significant because its only when the inventory is actually sold that it’s deducted, regardless of when the inventory was actually purchased or paid for. With the “cash basis” it means recording COGS when the inventory is purchased and paid for. So regardless of when it sells, the deduction is taken at the time or purchase.

If you are doing the accrual method for inventory, you will want to pull this Inventory Valuation report.

This report is essentially telling you how much inventory you ended the year with. You can pull the report at any time to see how much inventory you have in the warehouse. This report is a factor in your overall Cost of Goods Sold (COGS) for the year which is an expense on your taxes.

If you started selling on Amazon this year, your starting inventory will be 0. If you sold last year, you should have this same report from the year prior. When you pull it for December 31st, you are getting both your ending inventory as well as your starting inventory for the next tax year.

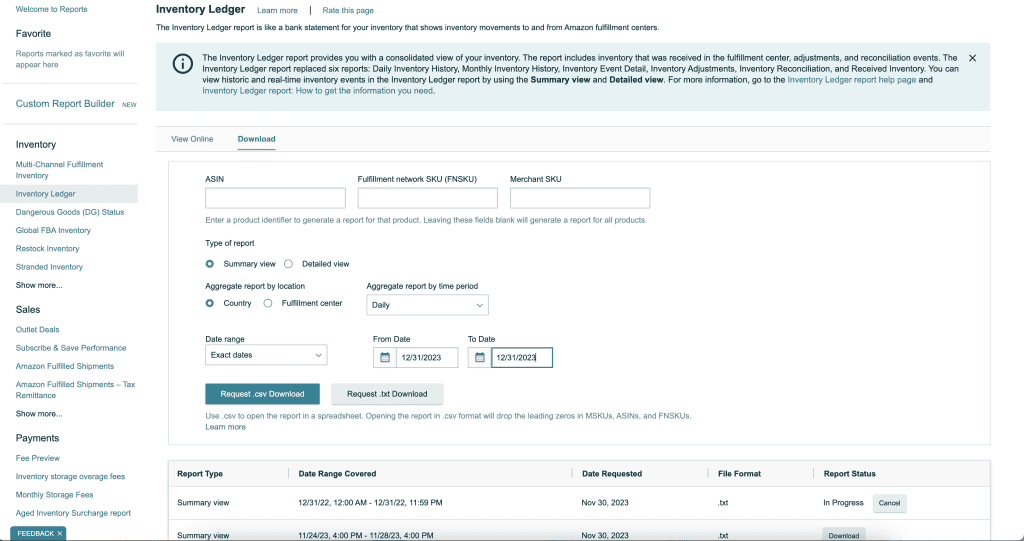

To pull your report:

- From your Seller Central account head to “Reports” and select “Fulfillment”

- In the top Inventory section, select “Inventory Ledger”

- Click the “Download” View to be able to generate a downloadable file

- Select the “Summary View”, “By Country”

- Time period select daily because you only need what was there on 12/31.In Date range click exact dates and then pick 12/31

- Request the download in either .csv or .txt whichever one you prefer. It will then appear in the list of reports here on the page when it’s completed.

If you use Inventory Lab you can get the report by heading to Reports – Inventory Valuation, and then clicking the date you want (Shoutout to YSG Community member Alicia Jackson for sharing this!).

In Sellerboard to get the report go to, Reports – Stock History Report (Shoutout to YSG Community member Liz Jackson for sharing this!)

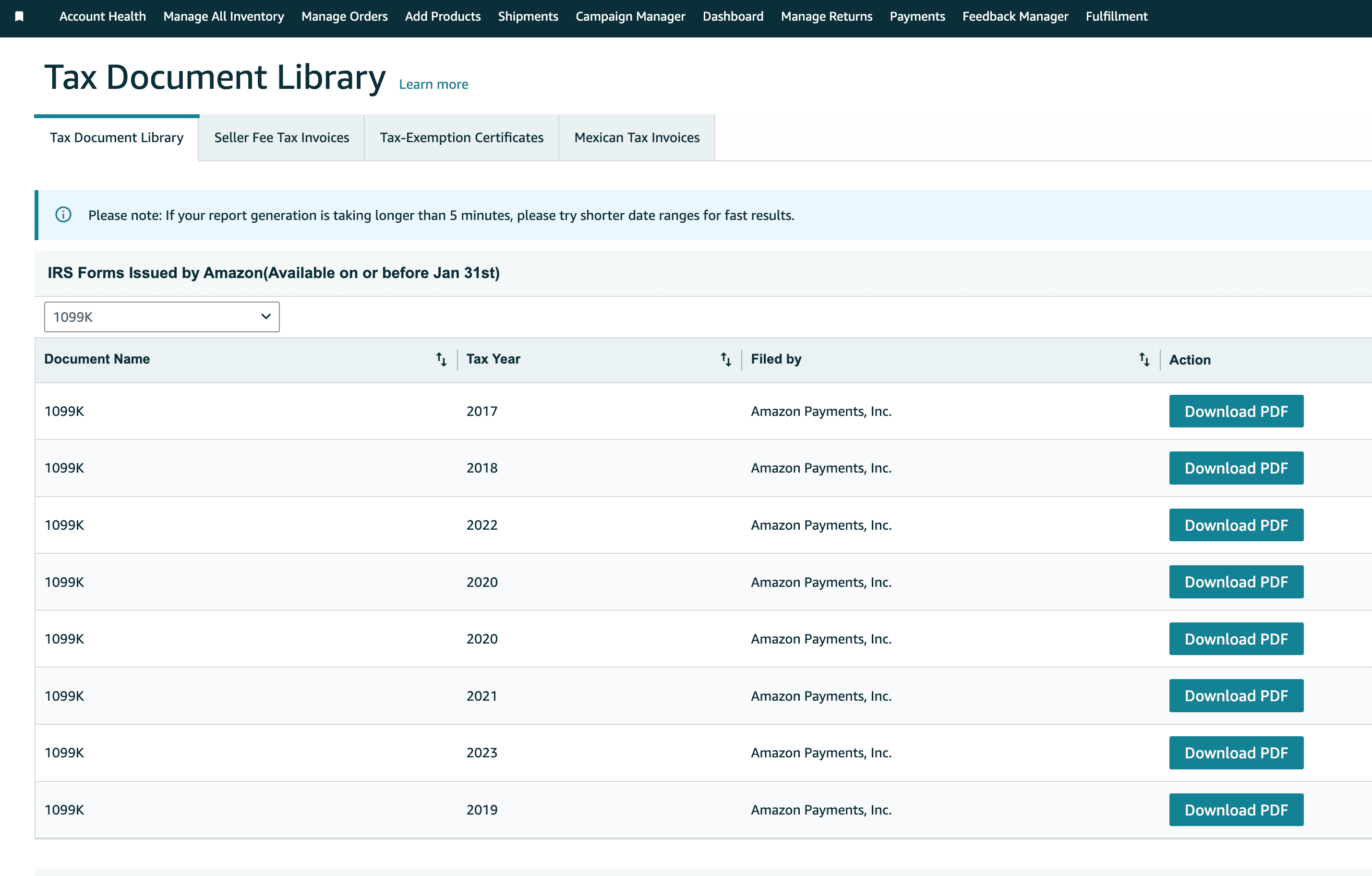

Amazon 1099-K for 2025 Taxes

The next report you will definitely need to grab is the 1099-K! If you did over $5,000 in sales (gross sales not profit) you will receive a 1099-K from Amazon. A 1099-K is the Payment Card and Third Party Network Transactions form, it is used to report transactions that are made via a payment processor. Amazon is the payment processor taking customer cards and so they report the amount they sent you to the IRS and provide you with the 1099-K.

If you met that threshold, the document will automatically appear in your Tax Document Library in Seller Central in the month of January, usually around the 3rd or 4th week. This document can be found under “Reports” > “Tax Document Library”. There is nothing you need to do or request from Amazon.

Amazon Payments Report Repository

This report is a MUST for every seller. Sometimes Amazon does not file the 1099 correctly or maybe you didn’t get one at all. This report has not only all the payments Amazon sent you but also all the expenses you will want to make sure you are deducting on your taxes!

Make sure to pull the Payments Report Repository so you can get a full picture of all your amazon payments and expenses – and that way you can report them and write off what needs to be. This includes things like – shipping, taxes, storage fees, etc. that you will need for your 2025 taxes as well.

To pull your report:

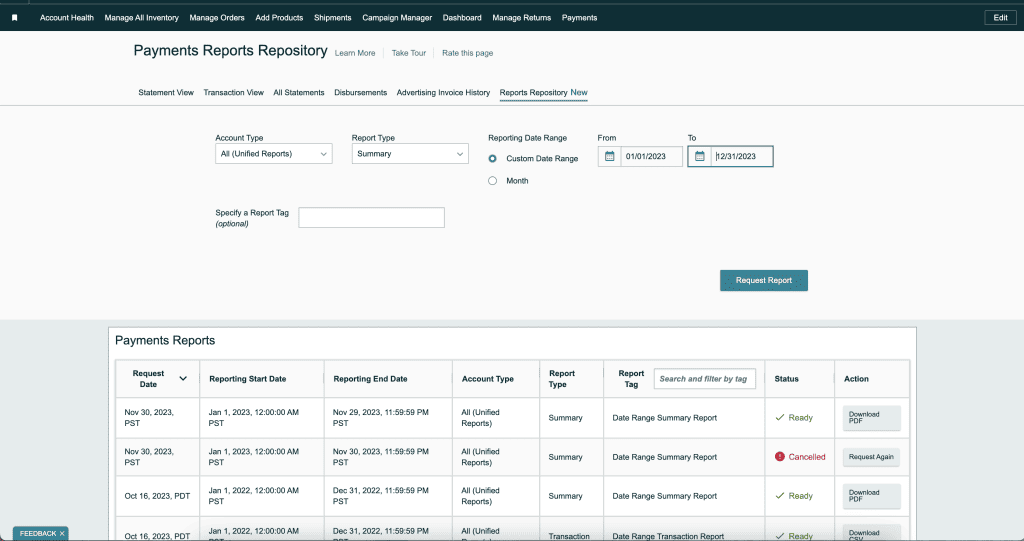

- Log in to Seller Central go to PAYMENTS > REPORTS REPOSITORY.

- It probably already is but make sure the account type you want says ALL (UNIFIED REPORTS).

- Select the SUMMARY option under Report Type.

- Select the CUSTOM date range option and enter from 01/01 of the year to 12/31 of the same year.

- Click REQUEST REPORT.

More on Income Tax

Thank you so much for reading along – talking about taxes with your Amazon Selling Business is always a long one! If you’d like the video version, you can watch it by clicking below or heading over to my Youtube channel. I share screenshots and step by steps through out the video. You can also check out the Your Selling Podcast – Episode 46 is an Interview with Mark Tew from Not Your Dad’s CPA, where we dive more into bookkeeping!