When Do You Need Amazon Business Insurance? Amazon Business Insurance Requirements Explained

As an Amazon seller, you may have heard about Amazon business insurance requirements but might not be sure when you actually need it. Today, we’re diving into the details of when Amazon requires business insurance, what kind of policy you need, and where you can get it—all to help you stay compliant and protect your business.

When Does Amazon Require Business Insurance?

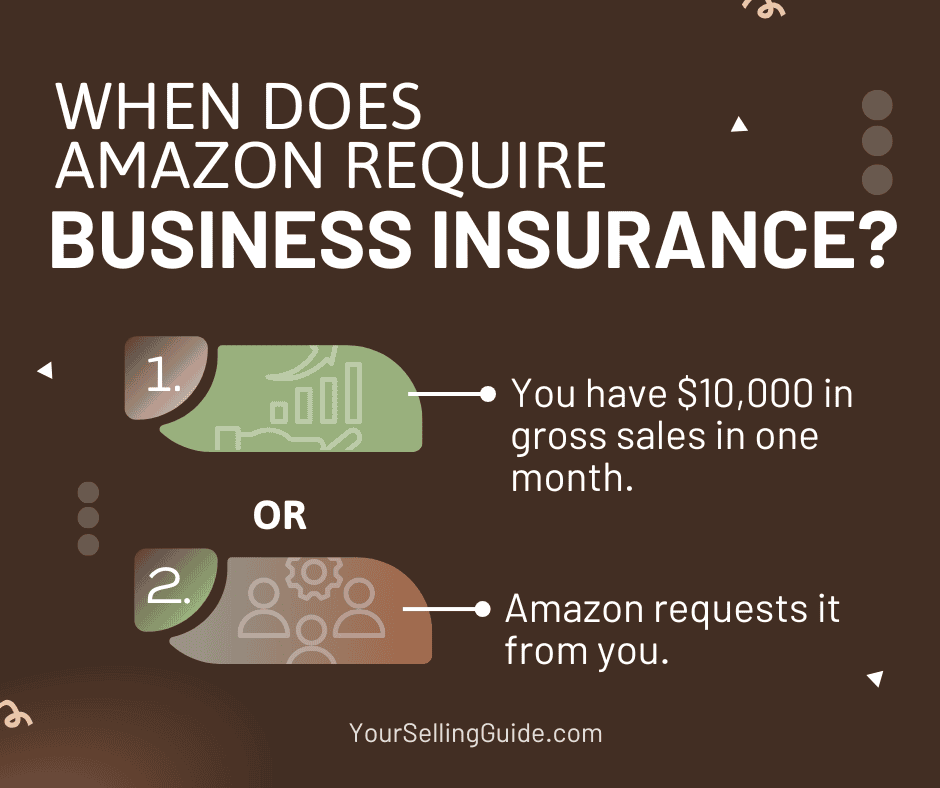

Amazon requires proof of Commercial Liability Insurance once you meet one of two conditions:

You have $10,000 in gross sales in one month – This applies to all sellers, regardless of business model (Retail Arbitrage, Online Arbitrage, Wholesale, Private Label, etc.).

Amazon requests it from you – Sometimes, Amazon will ask for proof of insurance even if you haven’t hit the sales threshold. If this happens, you must comply to keep selling.

This insurance policy is designed to protect both you and Amazon in the event a customer sues for damages related to a product you sold.

👉 Amazon’s official requirements: Amazon Business Insurance Requirements

Understanding Amazon Business Insurance Requirements

Amazon requires sellers to have a Commercial General Liability (CGL) policy that meets these criteria:

A minimum coverage of $1 million per occurrence and in aggregate.

Coverage must include product liability, bodily injury, and property damage.

The policy must list Amazon and its affiliates as additional insureds.

It must be written by an insurance provider with an AM Best rating of A- or better.

Ensuring that your policy meets Amazon business insurance requirements is crucial to avoid account suspensions and maintain compliance.

Where to Get Amazon Business Insurance

You can purchase business insurance from any licensed provider that meets Amazon’s business insurance requirements. Some sellers get policies through State Farm, Hiscox, or The Hartford.

My Personal Experience

I personally use Well Insurance, but my policy is underwritten by The Hartford. My policy costs around $500 per year, but rates vary based on your business model, coverage needs, and provider.

🔹 Be cautious of companies marketing specifically to Amazon sellers. Some of them charge higher premiums just because they target Amazon businesses. Like with any insurance, it pays to shop around for the best rate.

What Happens If You Don’t Get Insurance?

If Amazon requires you to submit proof of insurance and you fail to provide it, they can suspend your account until you comply. Since Amazon is tightening its enforcement on business insurance requirements, it’s better to proactively get a policy rather than scramble when you receive a request.

Final Thoughts: Do You Need Insurance Now?

If you’re a new or small-volume seller, you don’t need business insurance yet—but it’s good to plan ahead. Once you approach $10,000 in monthly sales, start looking at policies to avoid any disruptions to your business.

Key Takeaways:

-

Amazon business insurance requirements apply once you hit $10,000 in monthly sales or upon request.

-

You need a Commercial General Liability policy with at least $1 million in coverage.

-

You can get insurance from providers like State Farm, The Hartford, or Hiscox.

-

Shop around for the best rate—some companies overcharge Amazon sellers.

By staying ahead of Amazon’s insurance requirements, you ensure your business stays protected and compliant. If you’re close to the sales threshold, start shopping for Amazon business insurance today!

Want to Grow Your Amazon Sales Faster?

Finding profitable products is the key to increasing your revenue. Join the Retail Arbitrage BOLO Group to get exclusive product leads, expert insights, and a community of like-minded sellers to help you scale your Amazon business. Join the BOLO Group today!