Year-End Tax Reports and Documents for Amazon Sellers

Today we are talking about everyone’s favorite business topic, taxes! If you have sold over $600 dollars on Amazon, then you would need to add your Amazon business to your personal tax returns. In this post, I am walking you through what to gather for your CPA or tax professional.

Note: I am not a tax expert, please consult an expert when it comes to your taxes. All information below is for sellers who have a professional account. If you have an individual account some information may be different on the Amazon side.

There are six items you should pull or gather for your personal tax returns:

- Amazon Inventory Valuation Report

- 1099-K

- Amazon Summary Transaction Report

- Purchase Receipts

- Business Expenses

- Vehicle Milage

Inventory Valuation Report

The First Report you should pull if you haven’t already is your Inventory Valuation report. You should always pull this report on the 1st of the year but if you missed it, go ahead and grab it as soon as possible.

This report is essentially telling you how much inventory you ended the year with. You can pull the report at any time to see how much inventory you have in the warehouse. This report is a factor in your overall Cost of Goods Sold (COGS) for the year which is an expense on your taxes.

If you started selling on Amazon this year, your starting inventory will be 0. If you sold last year, you should have this same report from the year prior. When you pull it on the 1st you are getting both your ending inventory as well as your starting inventory for the next tax year.

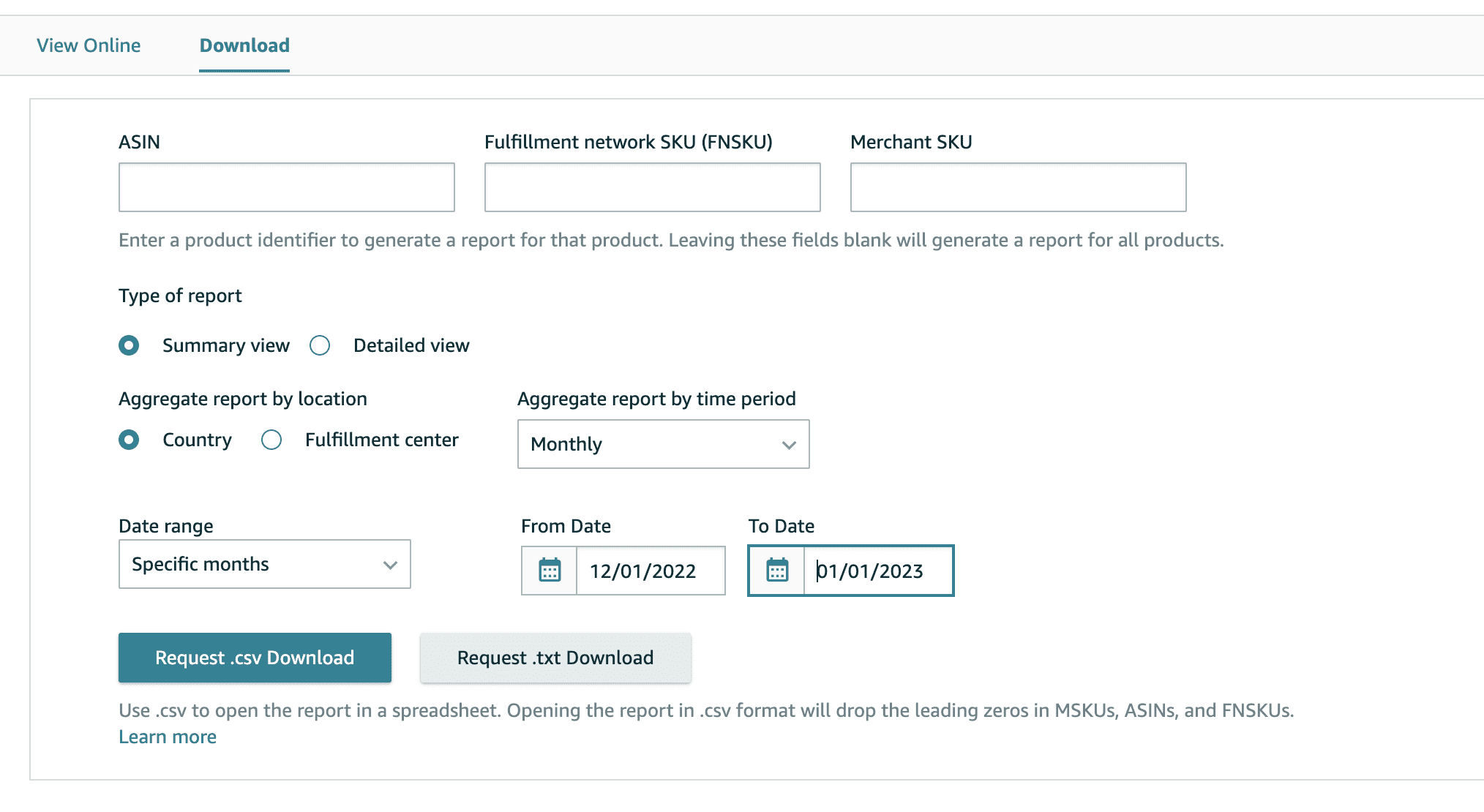

To pull your report:

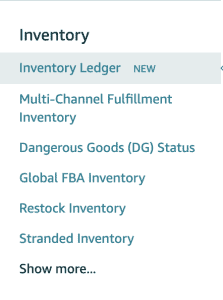

- From your Seller Central account head to “Reports” and select “Fulfillment”

- In the top Inventory section, select “Inventory Ledger”.

- Click the “Download” View to be able to generate a downloadable file.

- Select the “Summary View”, “By Country”, Monthly.

- You’ll click on the Date Range and select “Specific Months”.

- You want just the month of December so select from December 2022 to January 1, 2023.

- Request the download in either .csv or .txt whichever one you prefer. It will then appear in the list of reports here on the page when it’s completed.

Amazon 1099-K

The next report asked about often is what does Amazon provide as far as a tax document. If you did $600 in sales (gross sales not profit) you will receive a 1099-K from Amazon. This is the 1099 form for payment card and third-party network payment transactions, so essentially Amazon is the payment processor taking cards and so they report the amount they sent you to the IRS and provide you with the 1099-K.

If you met that threshold, the document will automatically appear in your Tax Document Library in Seller Central in the month of January, usually around the 3rd or 4th week. This document can be found under “Reports” > “Tax Document Library”. There is nothing you need to do or request from Amazon.

Amazon Summary Transaction Report

If you did not hit that $600 in sales, don’t worry. Here is another report all sellers should pull for their taxes which will have the same amount Amazon paid you as the 1099 would.

You don’t have to wait for Amazon, you can pull this report anytime after the 1st. This report shows all the fees, commissions, advertising, and more that you paid for in your Amazon account.

To pull your report:

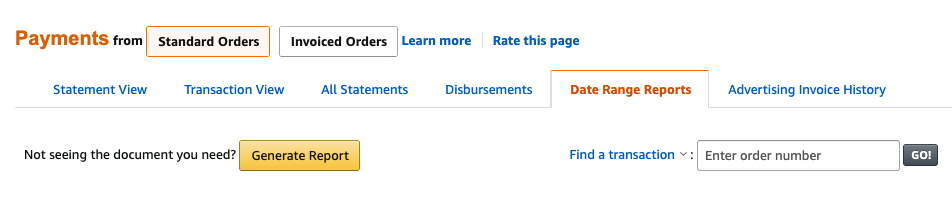

- From your Seller Central account head to “Reports” and select “Payments”.

- Select the tab that says “Date Range Report”.

- There should be a yellow button at the top that says “Generate Report”. Click the button.

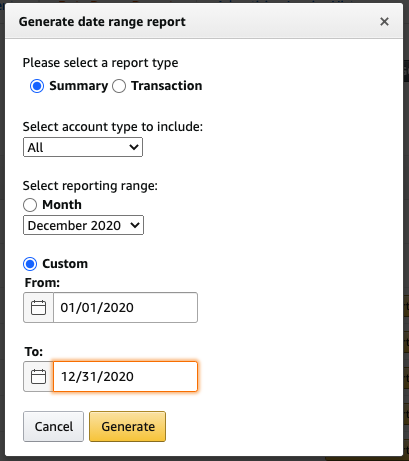

- Select “Summary” instead of Transaction because we want to see all the info, not on the individual transaction level.

- Enter the customer dates for the year, 1/1/22 – 12/31-22.

- Click “Generate” and the document will appear in a few minutes for you to download and save.

Purchase Receipts

You should be saving every receipt when it comes to your business. Personally, I use Receipt Bank, which I love because you just take your phone and take a photo of the receipt in the app, and Receipt Bank pulls it all into their system which can connect with accounting software or straight to your accountant. In their dashboard, you can see all transactions, categorize them, and download an excel spreadsheet.

No matter how you keep your receipts, make sure you keep them because you need that information for your COGS.

Business Expenses

The other thing that you need for your taxes is of course all of your business expenses. I have one business checking account and then two credit cards that I use for my business. I only use those three things for all business expenses. You must keep all your business purchases separate from your personal purchases.

All purchases made for your business are tax deductions as expenses on your business. So any courses, training, programs, software, supplies, commissions, etc. All of those will be expenses you need for your tax returns.

If you use accounting software like Quickbooks or GoDaddy accounting, you can set it up to pull in all your expenses. If you don’t have software and you do keep all your purchases separate, you should be able to pull your bank line item statements to categorize your expenses.

Vehicle Milage

The last things you want to be sure to grab is your car mileage for the car that you use for work. At the end of every year, I mark my truck’s overall mileage since it’s not just a work truck, it’s also available for personal use.

There are a lot of great apps out there that track your mileage for work and you want to be sure to utilize one of them as this is a deductible expense for your business.

That’s it! Those are the reports, numbers, and documents you need to pull for your personal tax returns. If you want more help or want to join my selling community, check out the groups here.